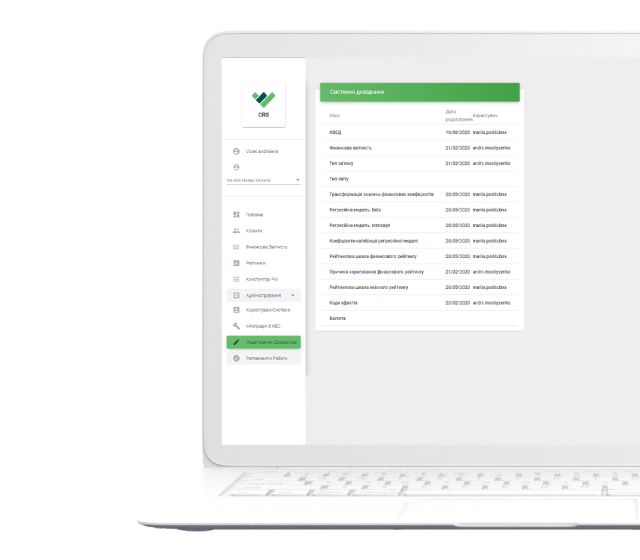

Customer Rating platform

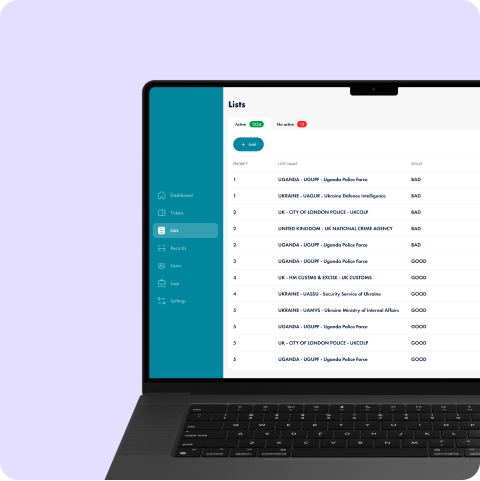

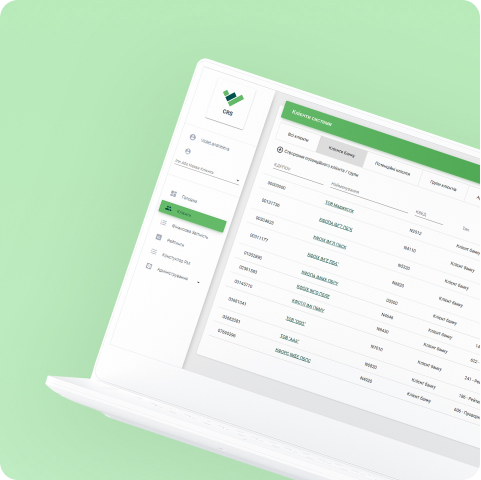

CRS is software for determining the rating of corporate clients (CB and IASB) to assess the creditworthiness of customers and calculate the probability of default in accordance with the needs of IFRS 9.

Basic functions

Hardware and software complex with which the client's rating is determined and the list of works on support and control over its changes.

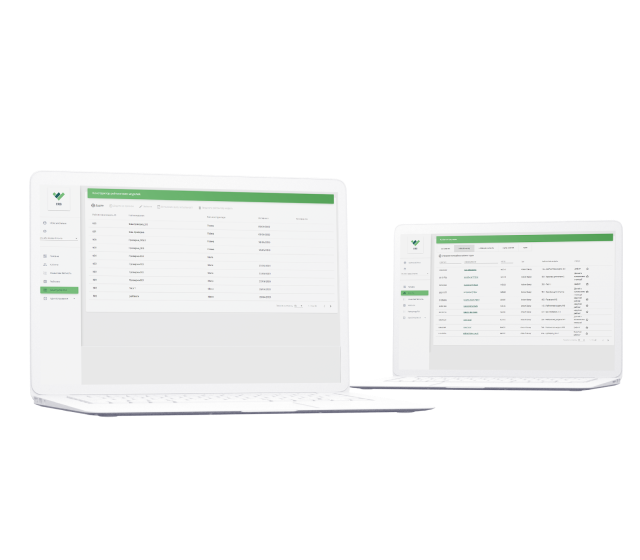

Advantages of the platform

The system implements rating according to the logic of the rating process on the basis of quantitative and qualitative data on the client, including attention signals, information about joining a group of clients.

The principle of operation

The result of the process of rating / analysis of creditworthiness is expressed in the establishment of the client the appropriate rating category on the scale; quantitative characteristic of creditworthiness, which is expressed in the probability of default during the year (rating of an individual client / group of clients).

An experienced team of professionals with an innovative approach

We have been working on the Ukrainian market since 2019, and have experience in the implementation and support of software for such companies as:

UNITY-BARS

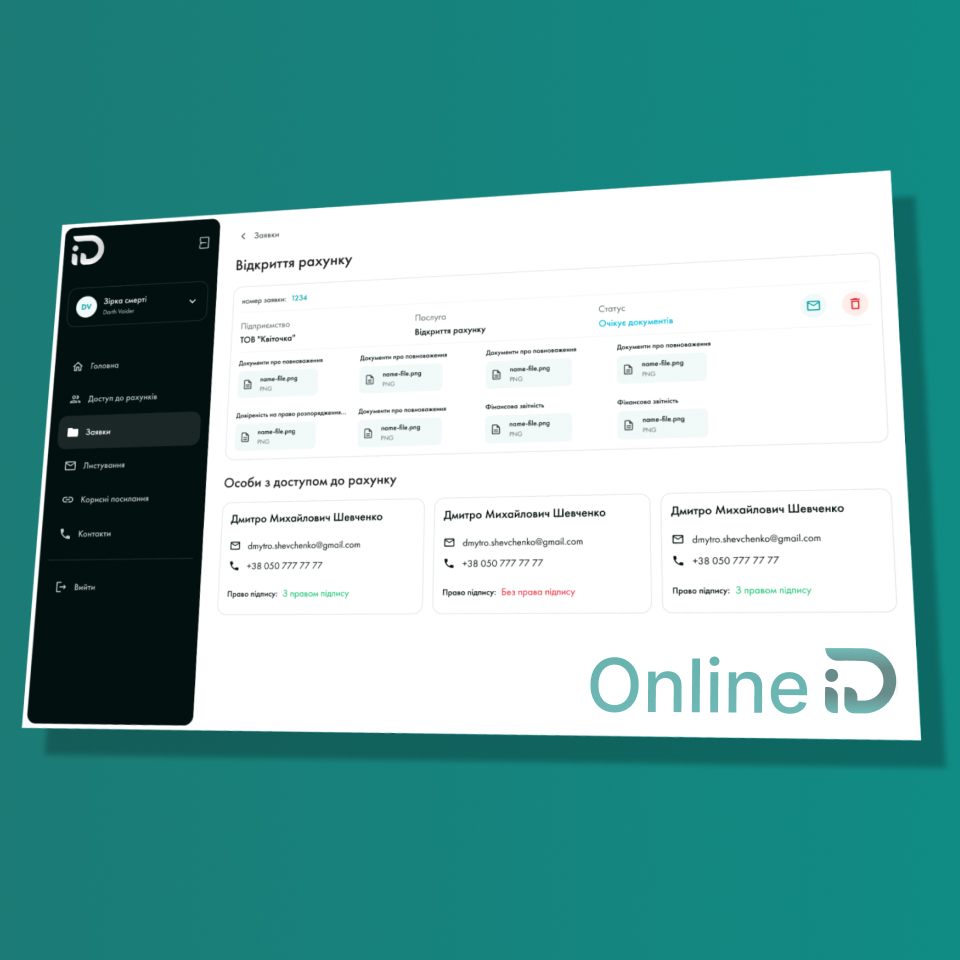

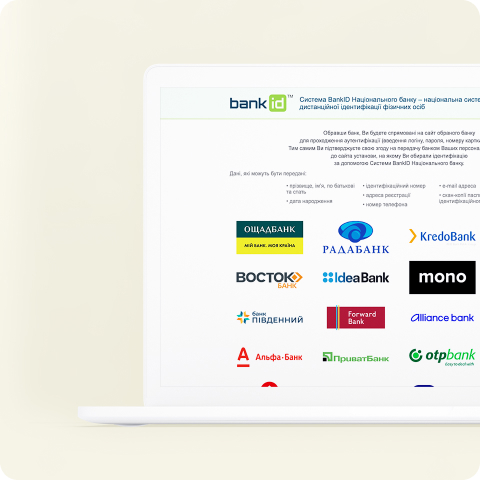

Identification and retrieval of customer data of banks and financial institutions.

T18

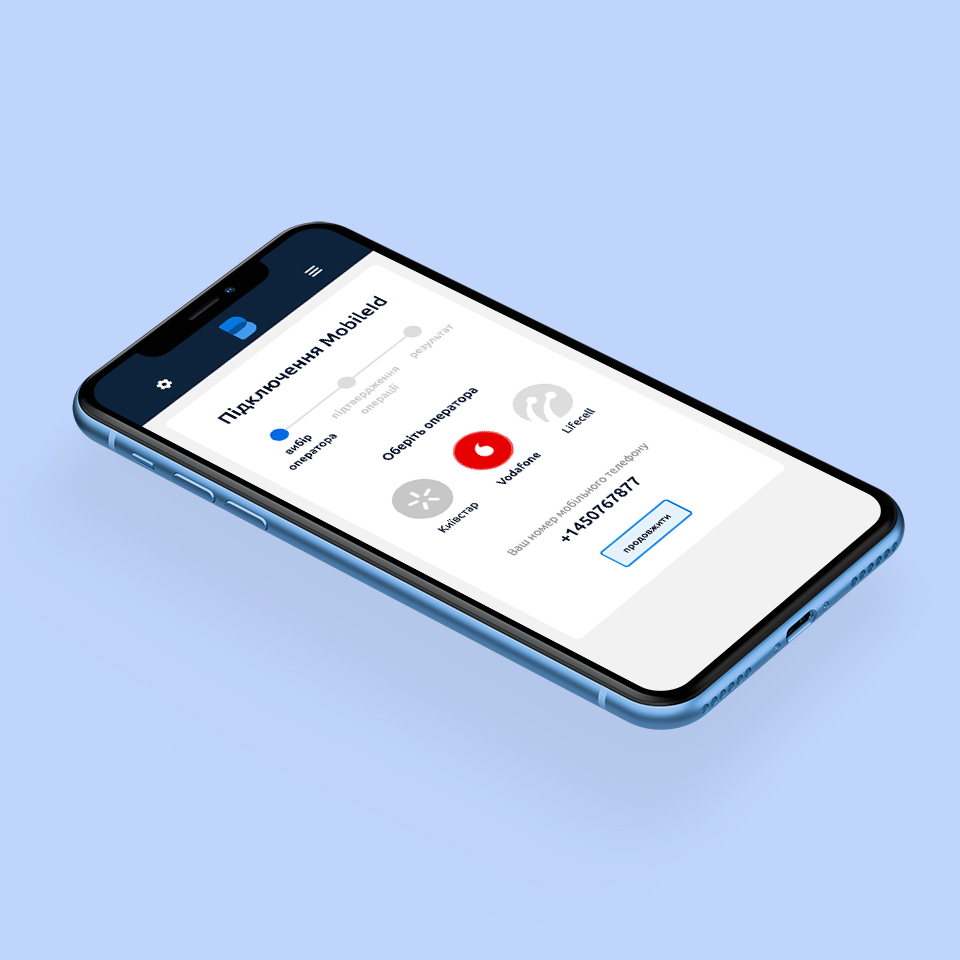

T18 is a leading tech company than pushes the boundaries of fintech and digital product standarts.

Globus Bank

Zero to top-charting mobile banking with great collaboration.

Oschadbank

Identification and retrieval of customer data of banks and financial institutions.

UBRD

The first Ukrainian bank with 100% Chinese capital and qualified financial institution

Publicis groupe

Partner with our clients, to make them Win in the Platform World.

RozetkaPay

RozetkaPay is a fintech solution for online payments.

Unex Bank

The first Ukrainian fintech startup with its own banking license.

ProCredit

ProCredit is a German development-oriented bank for Eastern and South Eastern Europe.