PureTrack

AML/KYC

Automated system of risk criteria and suspicion indicators analysis.

It's a powerful tool analyze operations and customers according to the relevant indicators and criteria

What are our advantages?

Specialized software development to meet regulatory requirements

Industrial solution with all the necessary basic indicators and criteria regulated by the banking system

Possibility to add your own verification rules & System events are also sent to email

Adjustments for the specifics of accounting in your country

Role models for dual control (analyst, controller, administrator)

Change logging (for auditing purposes)

What are the main features?

Obtaining data from banking systems

Launching sessions for checking rules and generating alerts

Appointing analysts to analyze alerts

Processing of the alert by the analyst

Controlling the alert processing & reporting

Updating information in banking systems

01/ Obtaining data from banking systems

The PureTrack system, in order to minimize the impact on other bank systems, works exclusively with data in its database.

The exchange with CORE Banking System and other systems takes place according to the schedule, during non-operational hours.

Receives new data, namely the delta of changes from the last exchange

Checks the data for correctness & adds to the main analysis database

Forms a list of customers for whom there were changes, for further processing

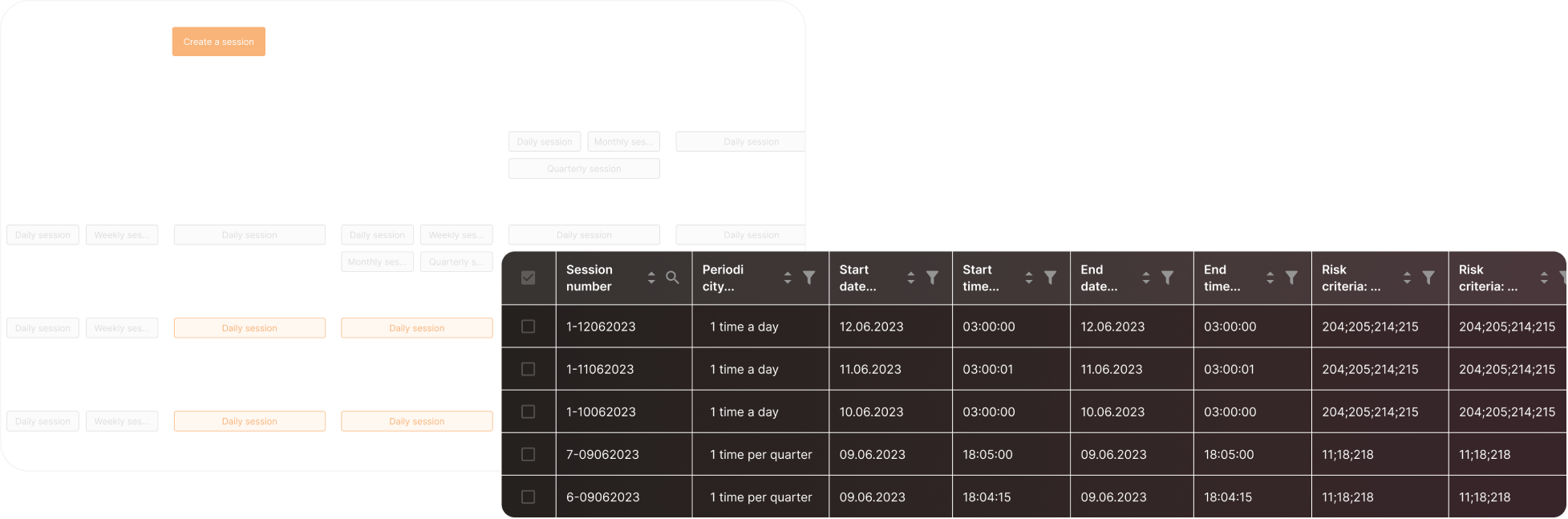

02/ Launching sessions for checking rules and generating alerts

Each stage or cycle of verification in the system is called a session.

As a result of checks, alerts are generated for suspicious customers.

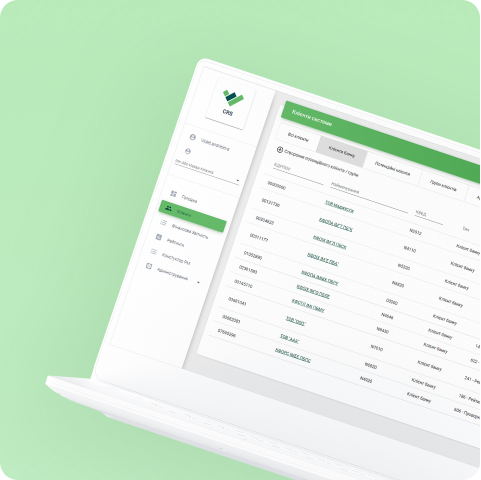

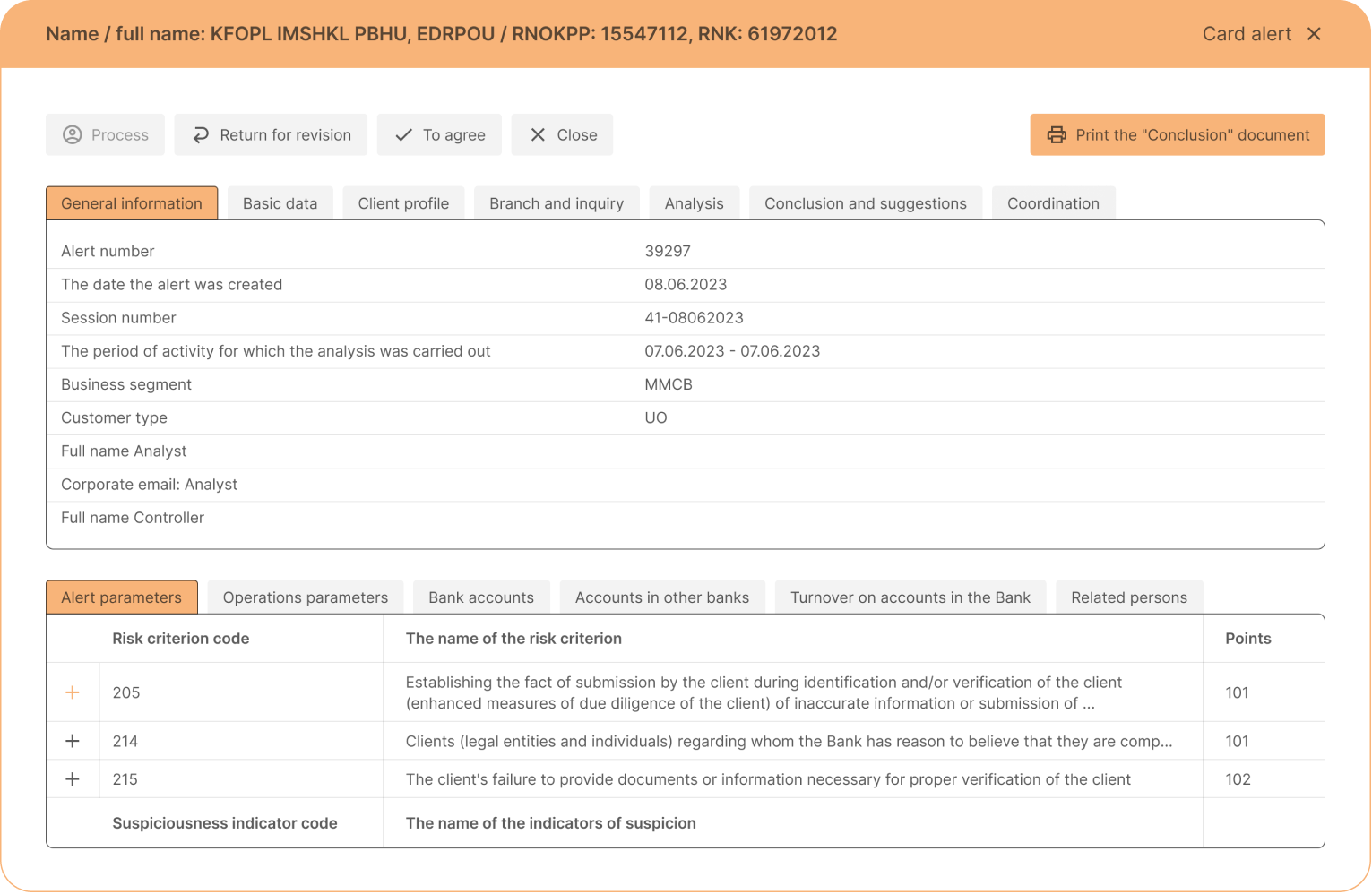

Working with Alerts

Alert processing in a single window displaying all the necessary information about the client, his related persons, accounts, transactions and balances

Supplementing the alert card with additional information

Activation confirmation or rejection

Conclusion generation

Printed forms generation (printing of the alert processing report)

Schedule and execution time change

Features List

System user management (creation, configuration, role selection, user blocking, password reset)

Management of system directories

Administration of risk criteria and their performance parameters

Administration of indicators of suspicion and their performance parameters

Logging of all changes and user actions

Inspection calendar according to daily, weekly, monthly and quarterly inspections

Viewing performed checks (sessions) and possible errors

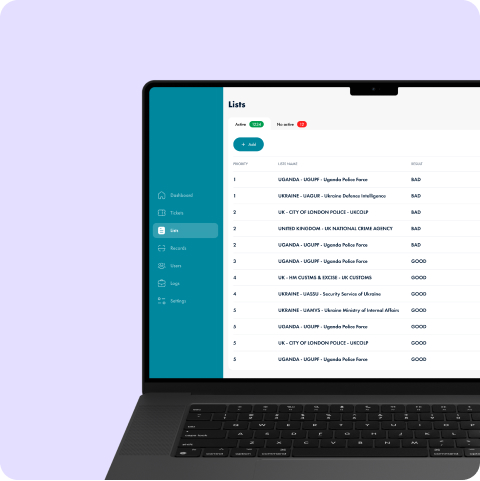

Working with the alert register (sorting, searching, filtering)

Working with alerts & reports

Technical Characteristics

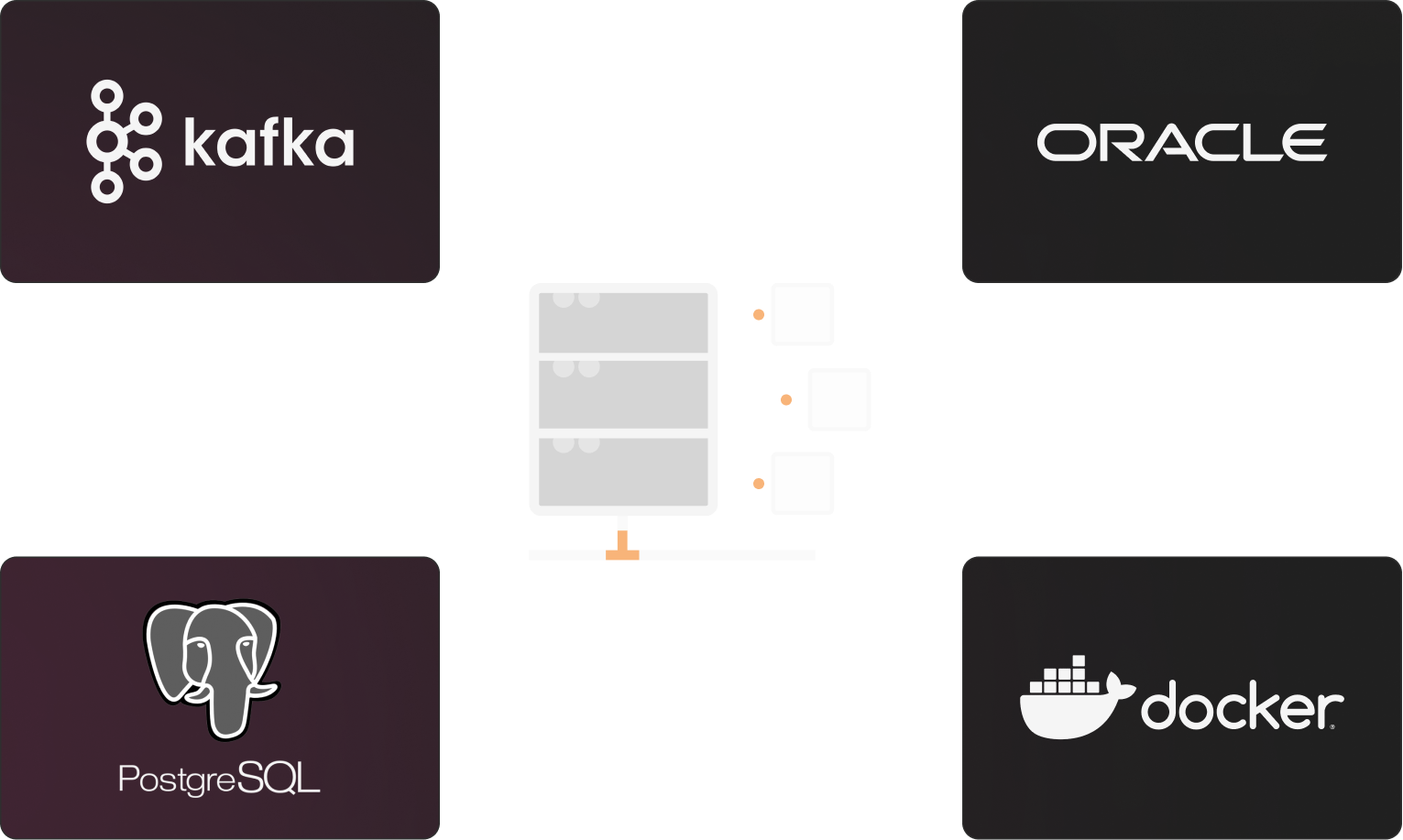

Microservice architecture with horizontal and vertical scaling

Real experience of operation on volumes of 2 billion transactions & Integration with Active Directory and mail servers

Support for modern data exchange solutions: Rest API and Kafka

Use of modern technologies and operating environments (containers)

Works with Oracle, PostgreSQL and other databases (*depending on data volumes)

Integration with the bank's systems to transfer the results of alert processing according to the rules

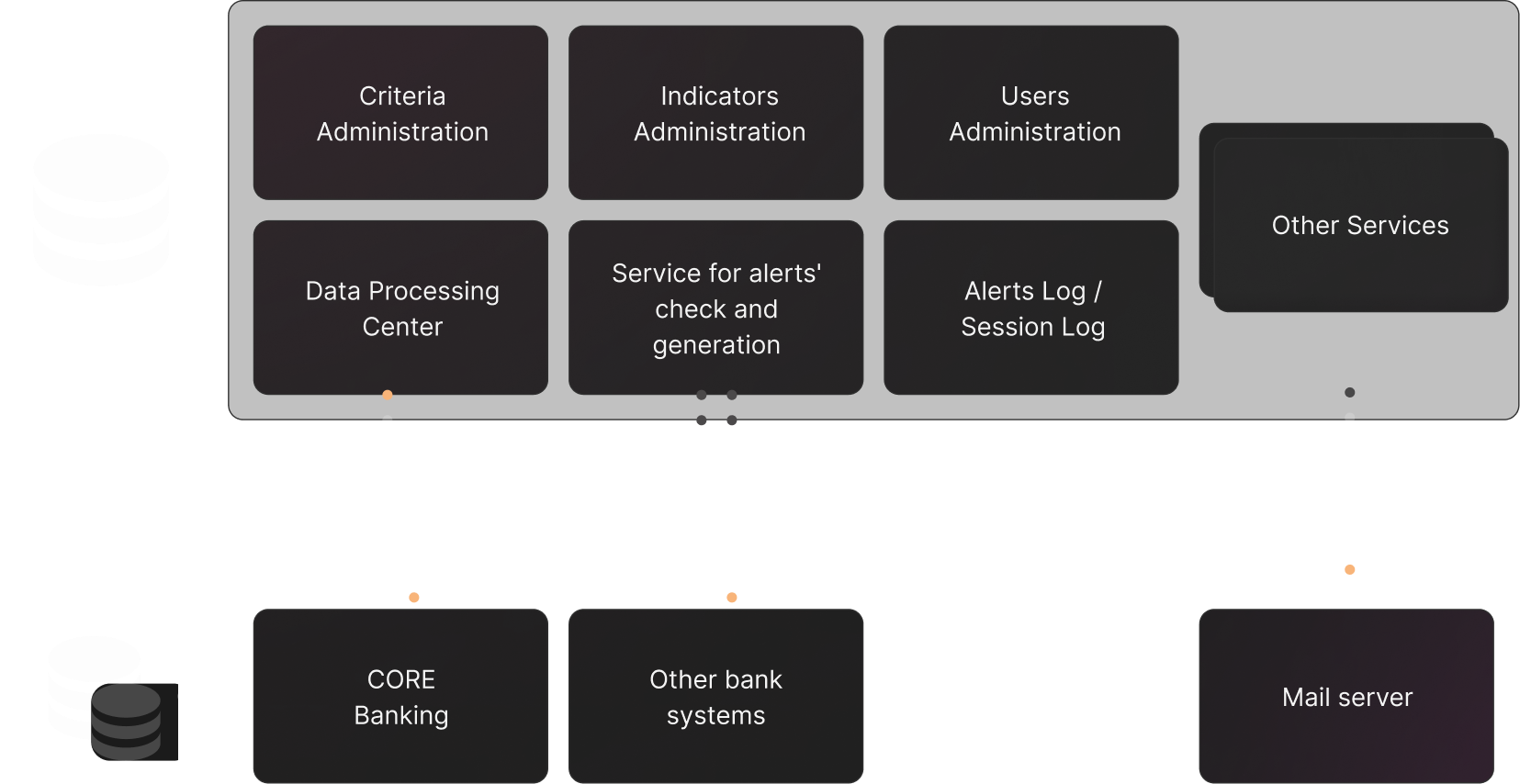

Technical Architecture

To minimize dependencies and optimal use of resources, the PureTrack system can work in several modes with the automated banking system (ABS)

Autonomous use

All available information is transferred to the system. On the basis of this information, checks (formation of alerts) and post-analysis by the analyst take place

Semi-autonomous use

Information transferred to the system is necessary only for analysis (formation of alerts), post-analysis by the analyst is carried out on the basis of data obtained from the bank's online systems

An experienced team of professionals with an innovative approach

We have been working on the Ukrainian market since 2019, and have experience in the implementation and support of software for such companies as:

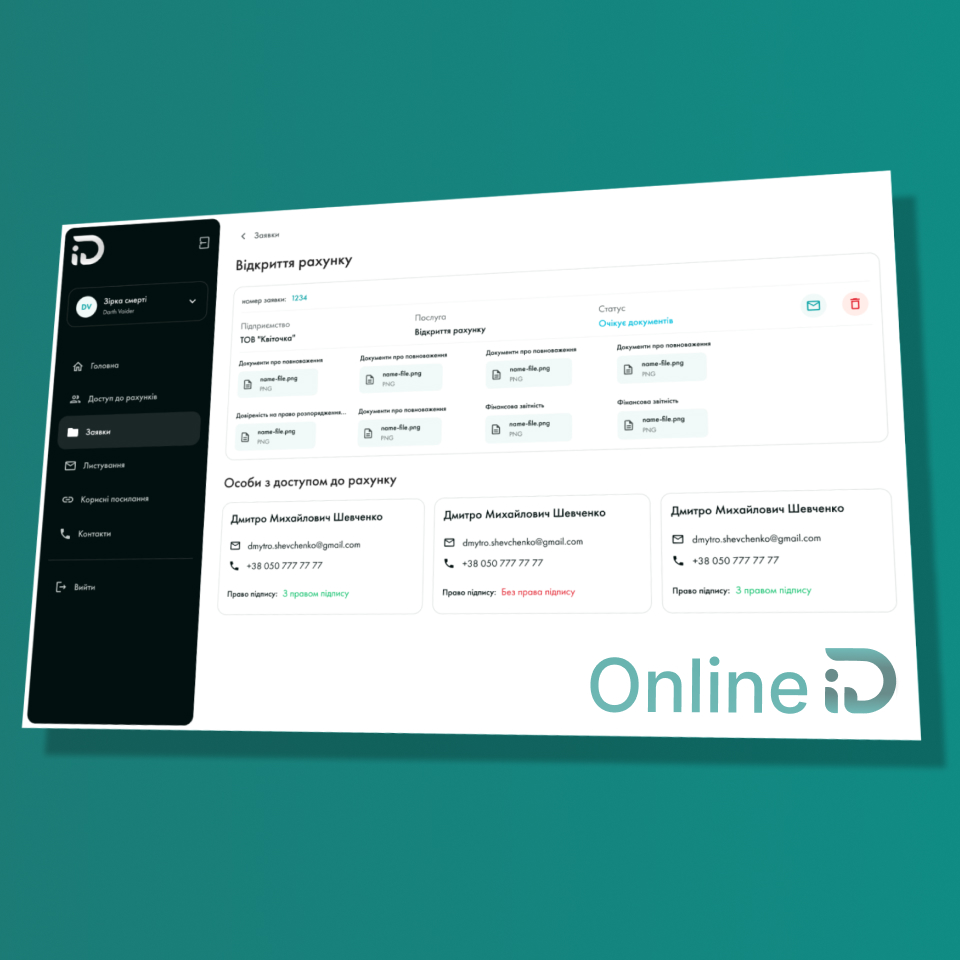

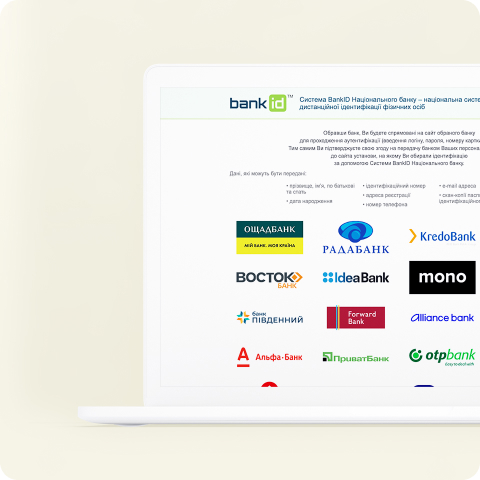

UNITY-BARS

Identification and retrieval of customer data of banks and financial institutions.

T18

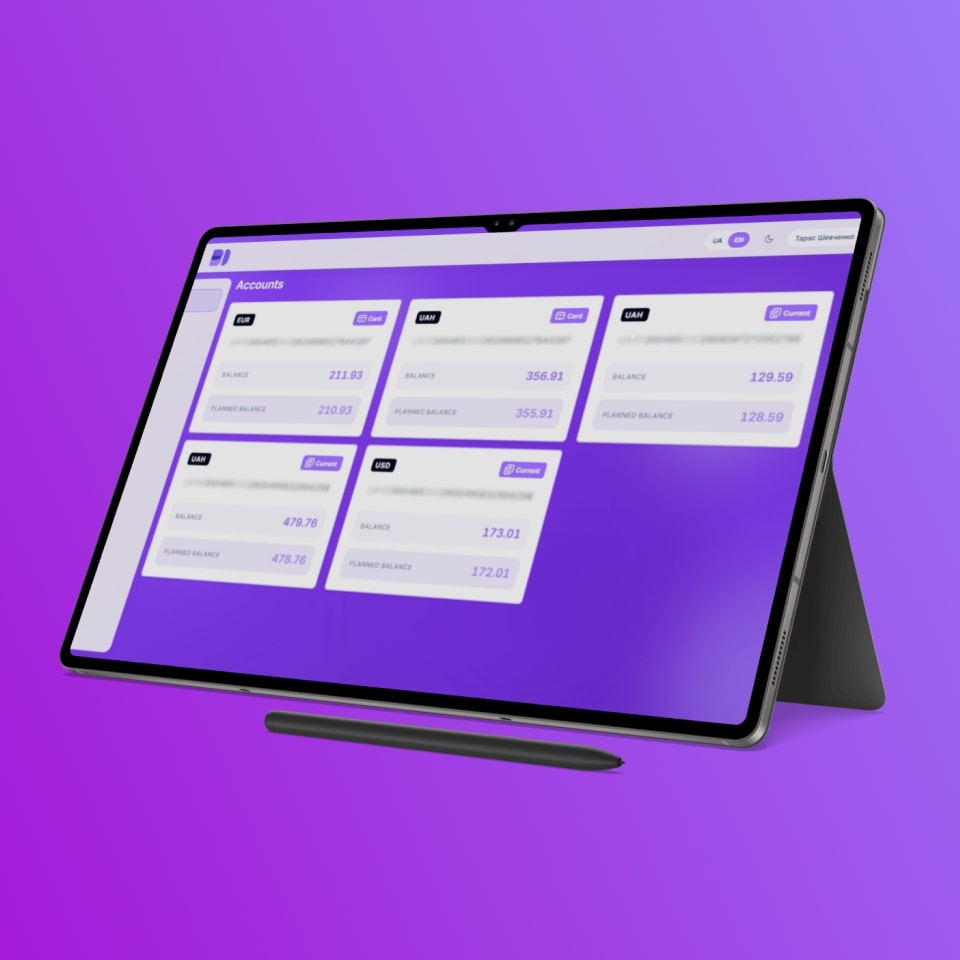

T18 is a leading tech company that pushes the boundaries of fintech and digital product standards.

Globus Bank

Zero to top-charting mobile banking with great collaboration.

Oschadbank

Identification and retrieval of customer data of banks and financial institutions.

UBRD

The first Ukrainian bank with 100% Chinese capital and qualified financial institution.

Publicis Groupe

Partner with our clients, to make them Win in the Platform World.

RozetkaPay

RozetkaPay is a fintech solution for online payments.

Unex Bank

The first Ukrainian fintech startup with its own banking license.

ProCredit

ProCredit is a German development-oriented bank for Eastern and South Eastern Europe.