PureTrack

Anti-fraud

Modification for online verification of card transactions (electronic acquiring)

What is PureTrack Anti-fraud?

Introducing our advanced system for automated online monitoring of operations within the acquiring network, complete with capabilities for post-operation analysis. Our solution supports stop lists and offers flexible rules for analyzing the behavior of payment card holders, ensuring enhanced security and compliance.

What does the system do?

Provides automatic monitoring of transactions in the bank/financial company network online.

Ensures the appropriate speed of transaction processing in accordance with the requirements of the MPS.

Ensures the necessary level of security and compliance with the requirements of international payment systems.

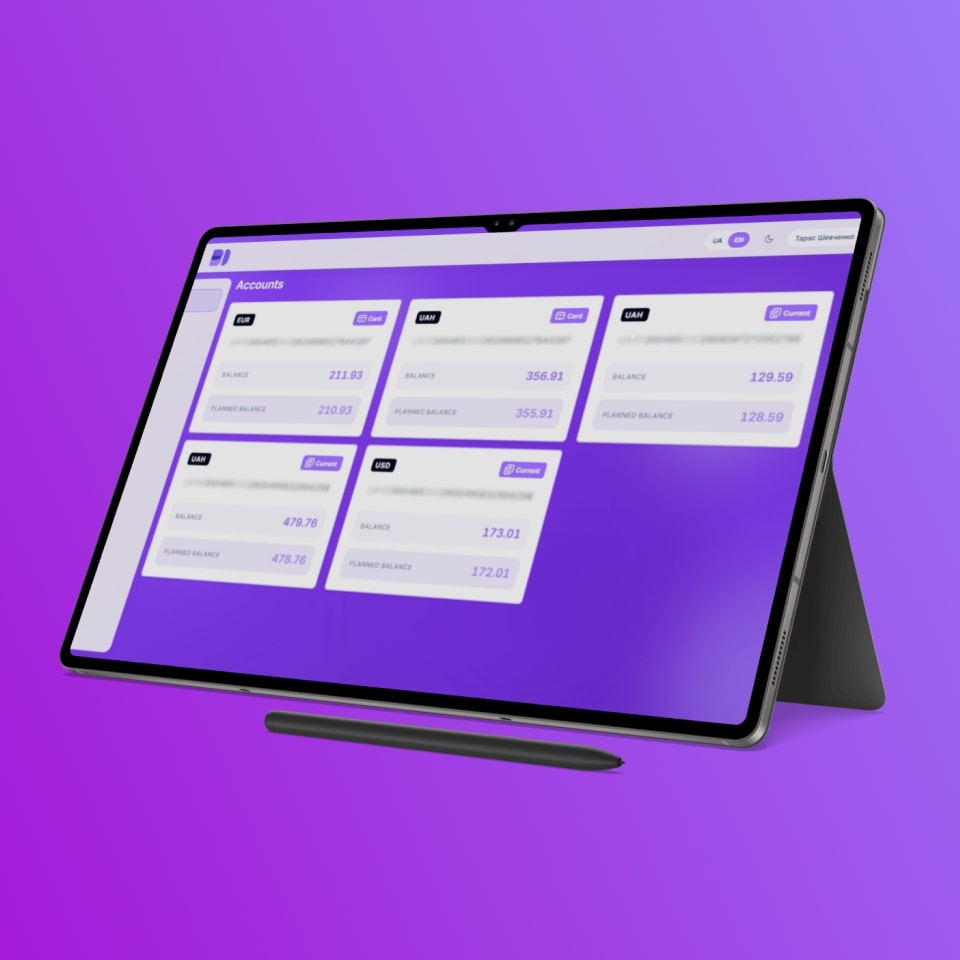

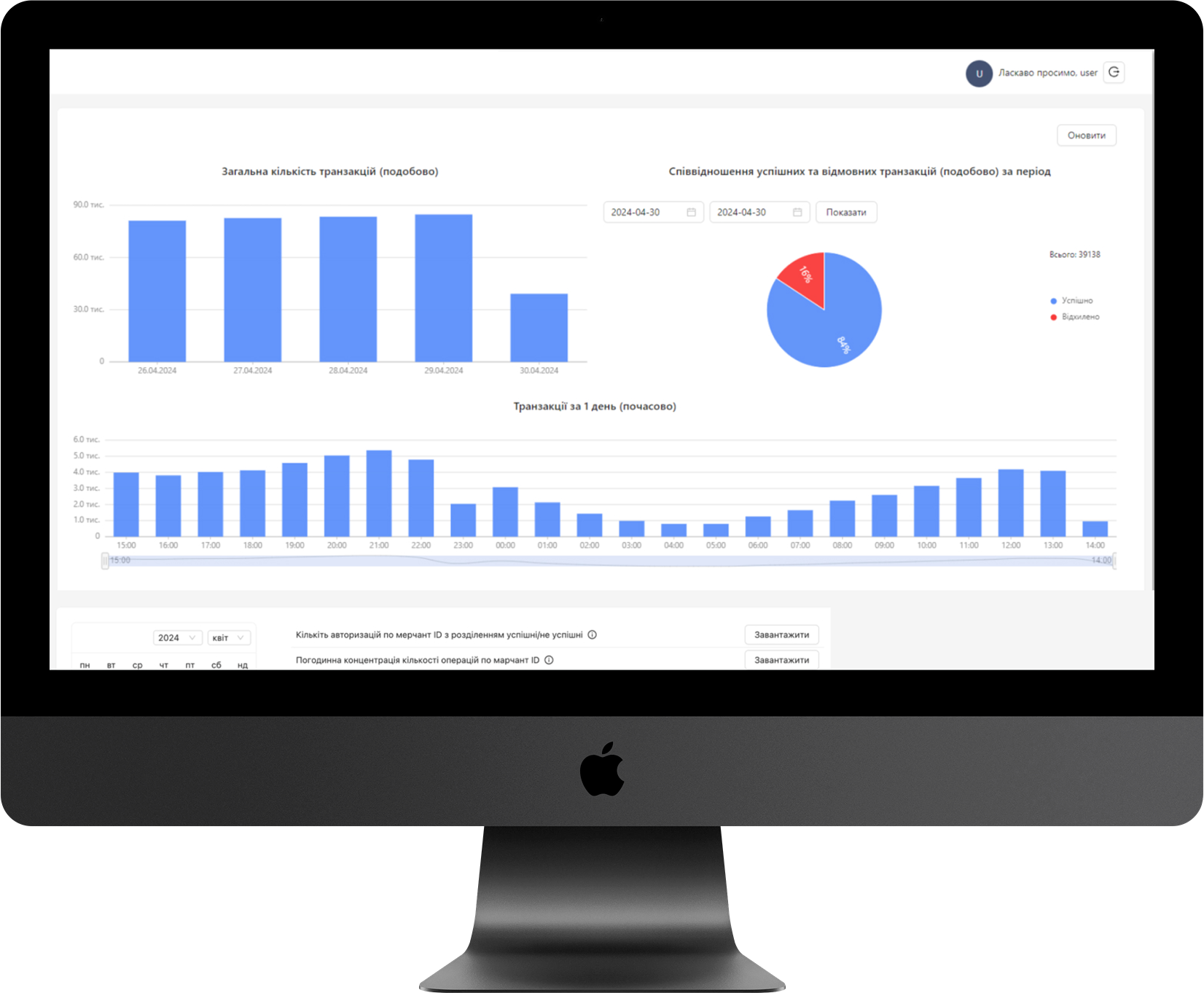

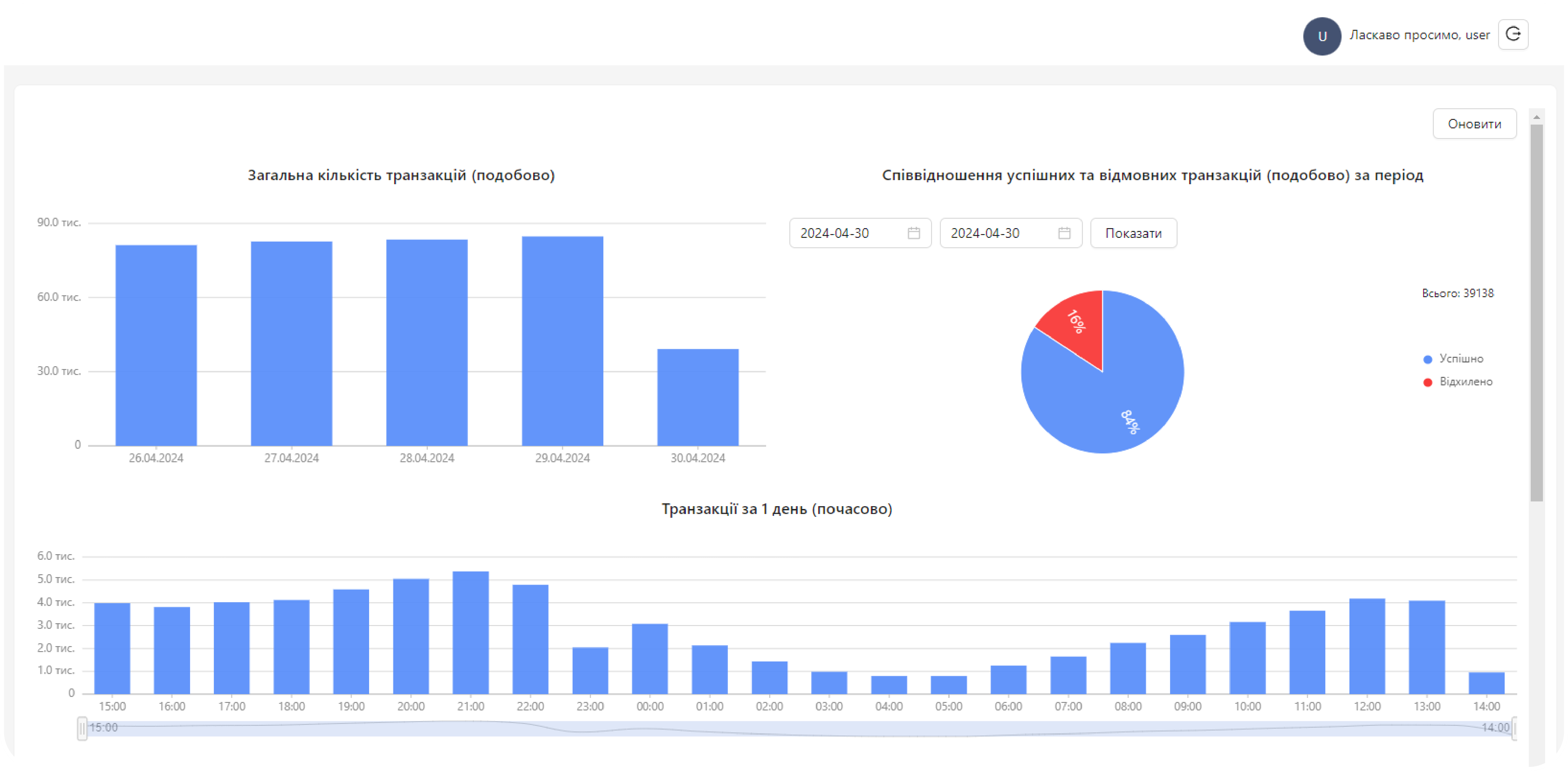

01/ Displaying the current status and statistics

An information panel is available in the system, which allows you to get information about the current work in a graphical form

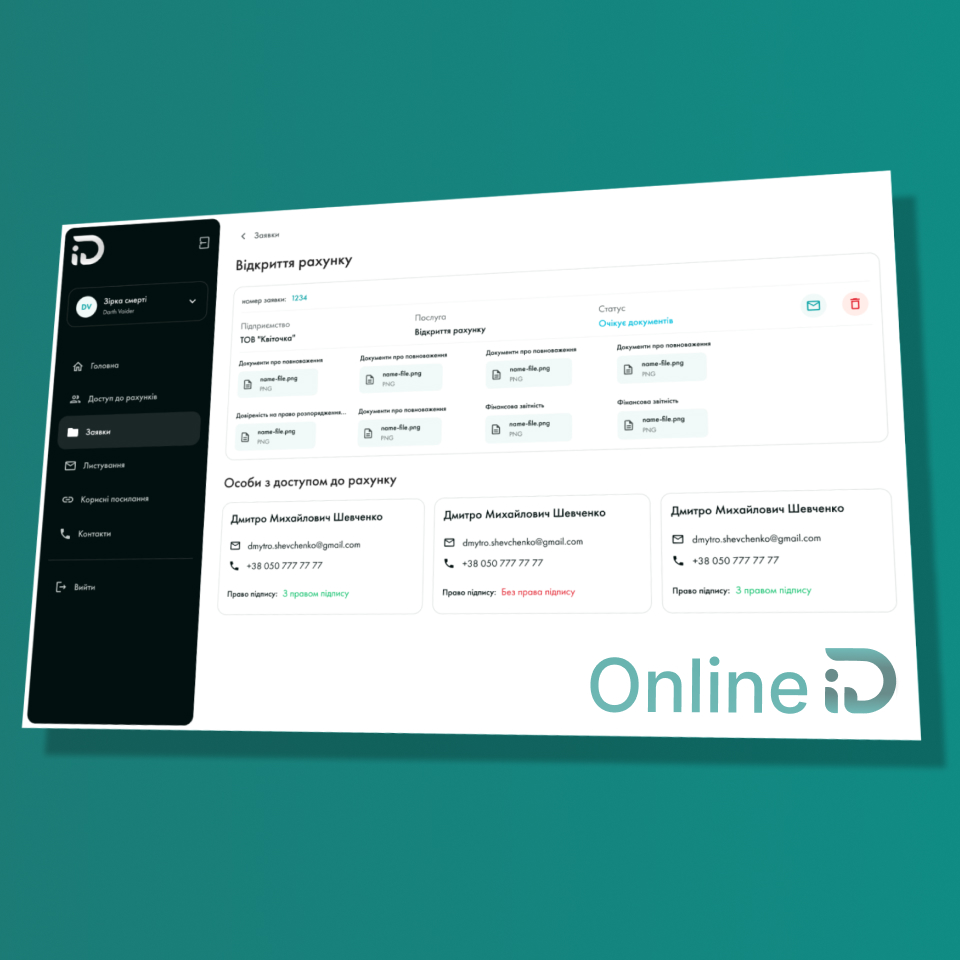

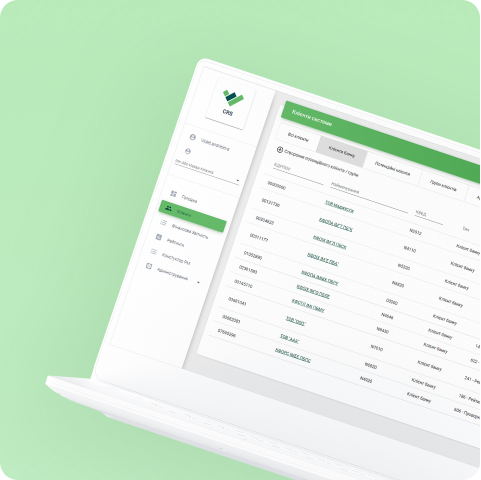

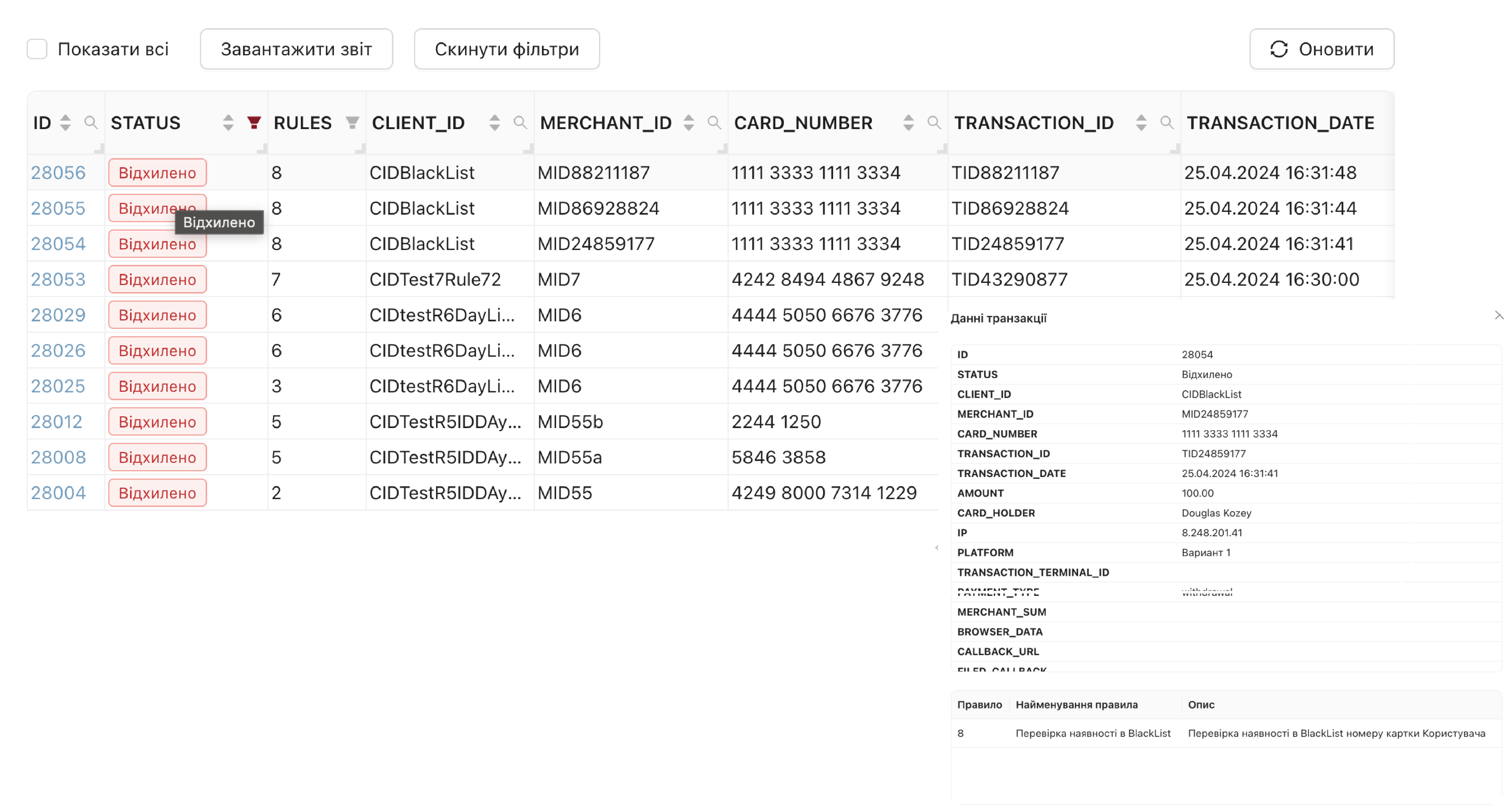

02/ Display history and inspection results

The system interface allows you to flexibly configure the display information, its search and filtering/sorting

Card numbers may be encrypted or stored/processed in masked form in accordance with the requirements of the Ministry of Internal Affairs and Communications

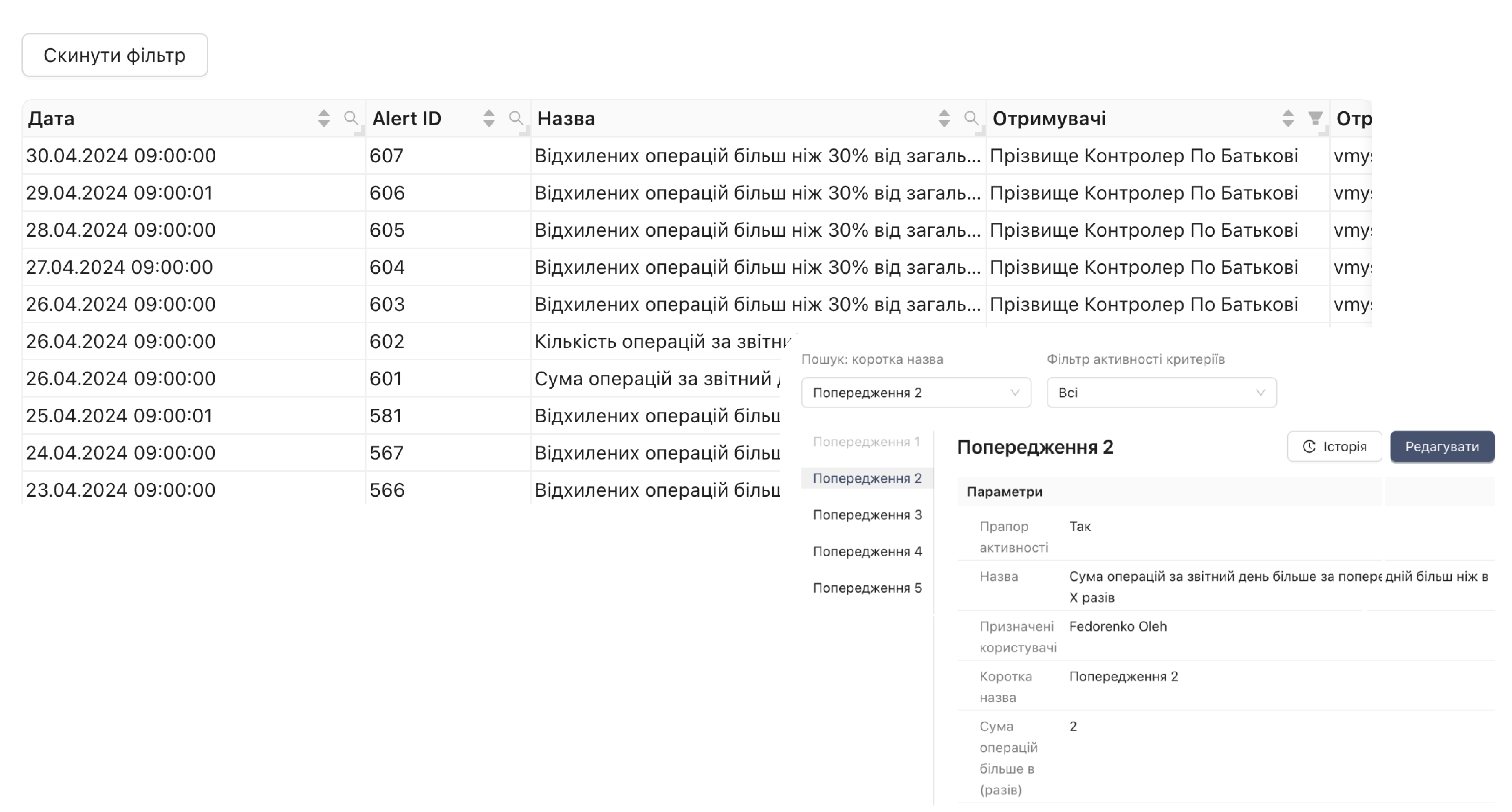

03/ PureTrack system warnings / alerts register

In addition to the display in the registry, the triggering of warnings is also duplicated by means of e-mail.

Responsible persons can be defined for each type of warning.

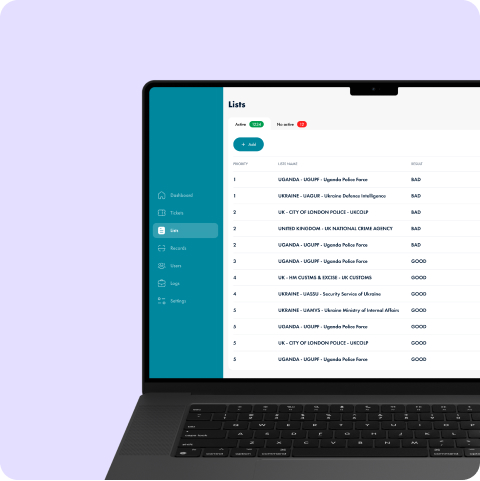

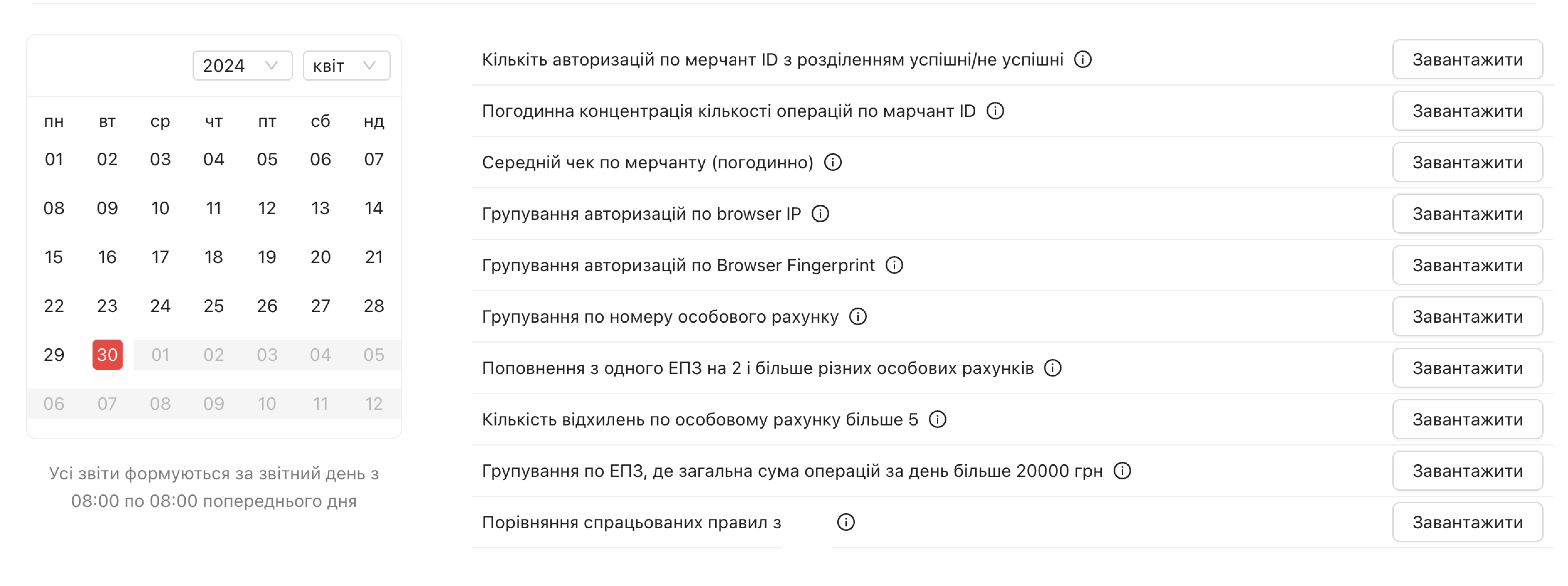

04/ List of available PureTrack reports

The system has pre-created reports that can be supplemented according to the needs of the customer

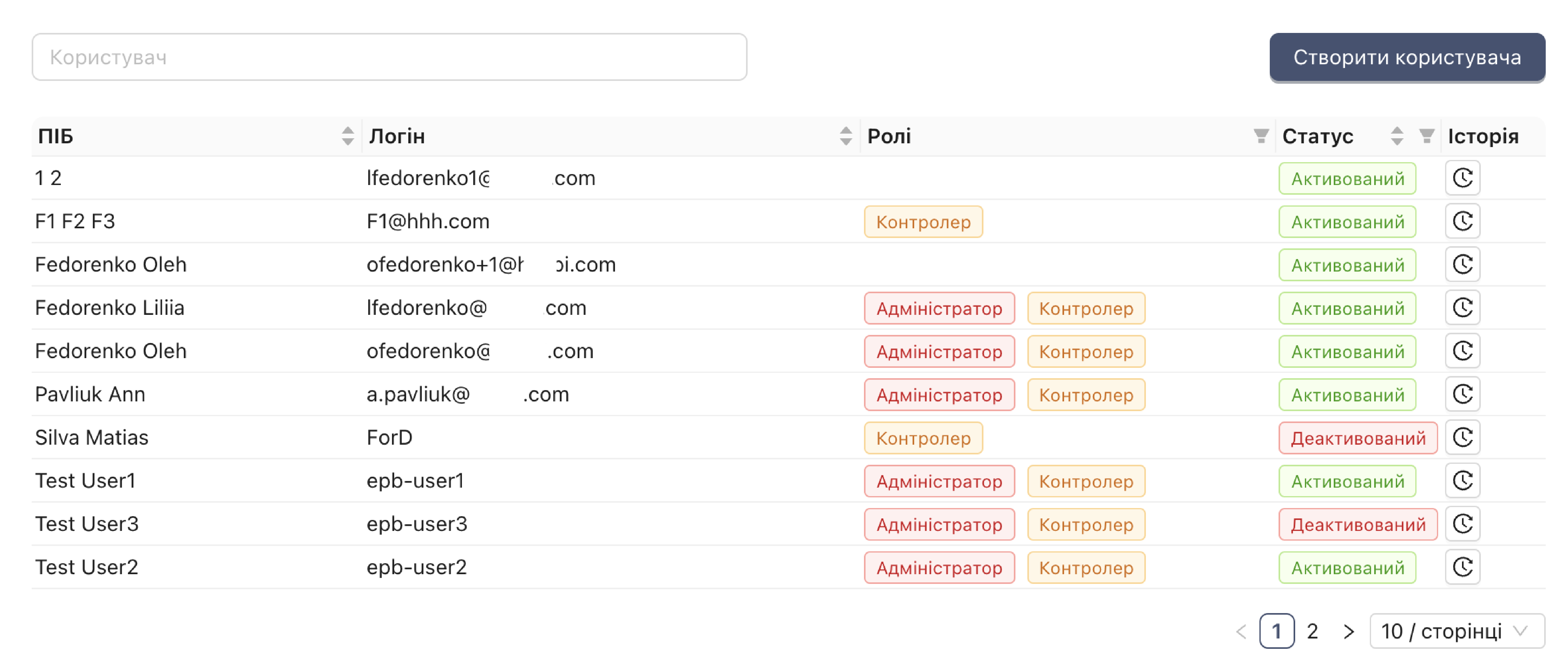

05/ PureTrack user management

The system implements a role model that provides for the separation of duties

Any changes to user parameters are logged by the system

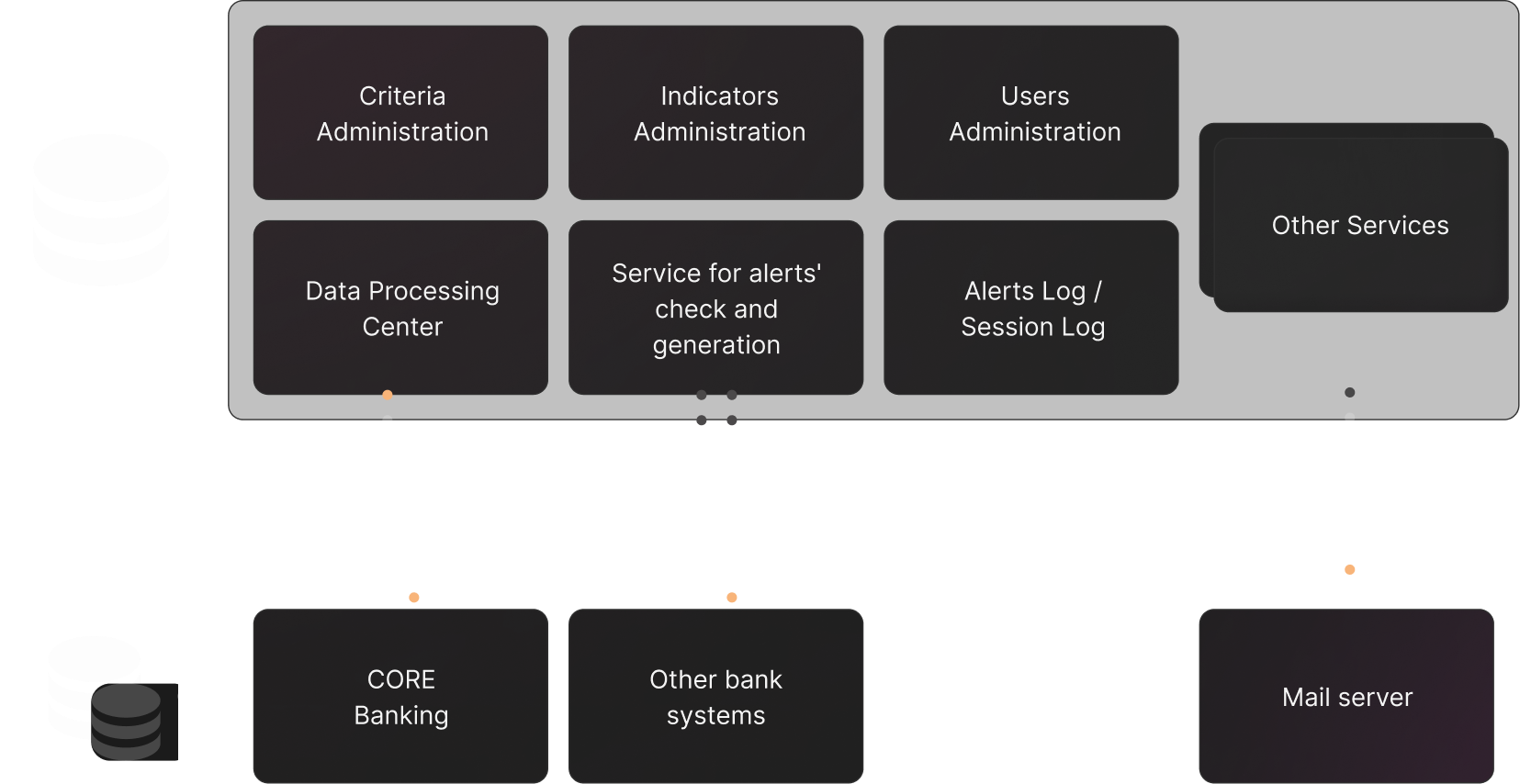

Technical Characteristics

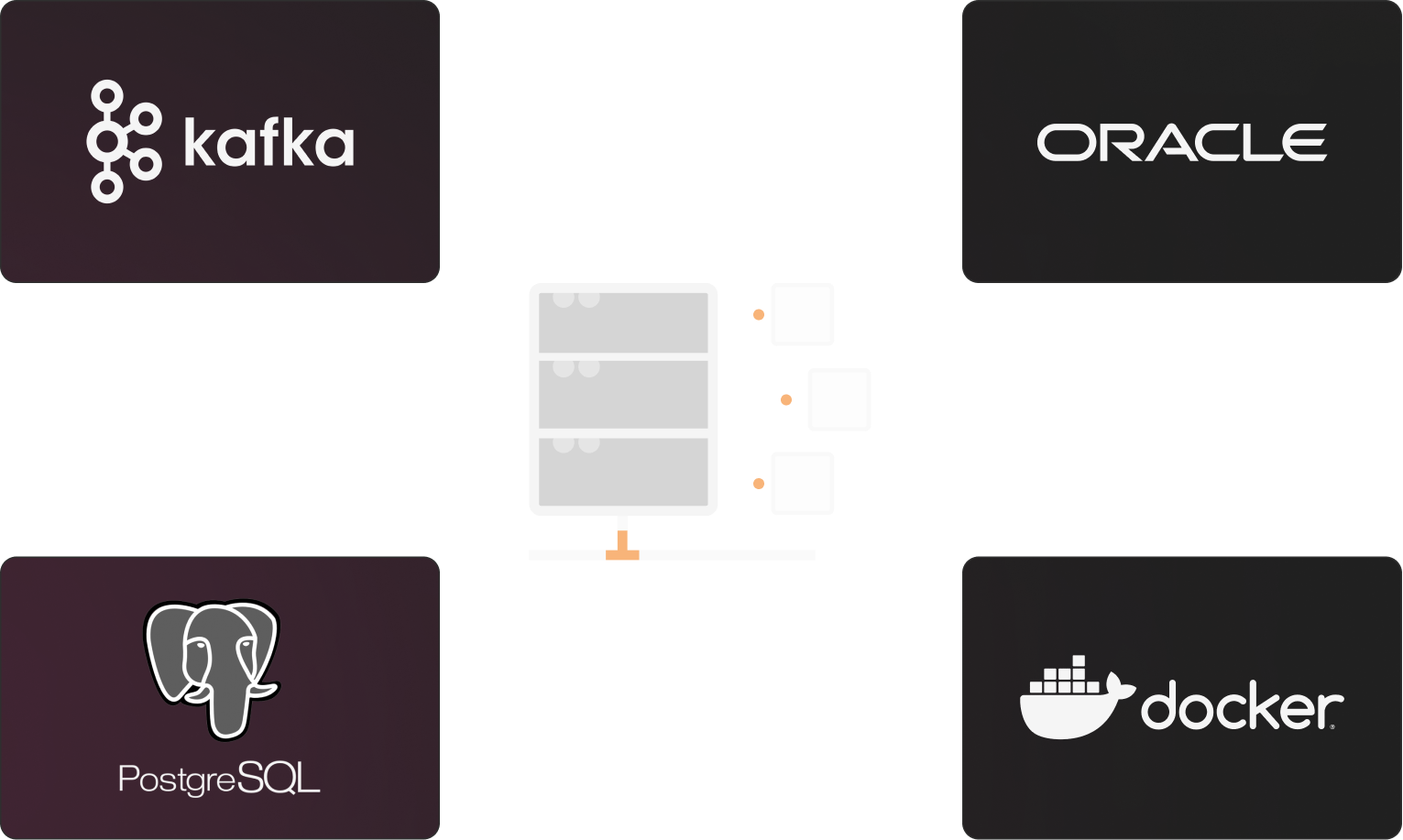

Microservice architecture with horizontal and vertical scaling

Real experience of operation on volumes of 2 billion transactions & Integration with Active Directory and mail servers

Support for modern data exchange solutions: Rest API and Kafka

Use of modern technologies and operating environments (containers)

Works with Oracle, PostgreSQL and other databases (*depending on data volumes)

Integration with the bank's systems to transfer the results of alert processing according to the rules

Technical Architecture

This system is available for purchase on different terms of use

Using software as a service

Working under the Software as a service model involves payment for work on modification and system launch without purchasing software.

This includes payment for all other work and maintenance and support costs.

Purchase of software

Full purchase of the software with payment of the license and work on configuration and start-up.

The provision of escort services is regulated by a separate contract.

Pay per use

A hybrid model that involves paying for setup and startup.

Payment for the use of the software is made according to the number of verified transactions for the reporting period.

An experienced team of professionals with an innovative approach

We have been working on the Ukrainian market since 2019, and have experience in the implementation and support of software for such companies as:

UNITY-BARS

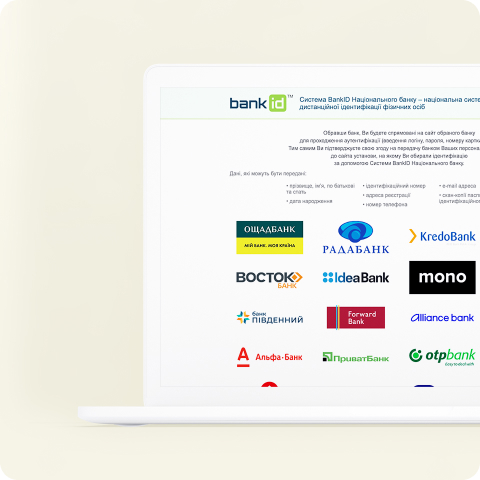

Identification and retrieval of customer data of banks and financial institutions.

T18

T18 is a leading tech company than pushes the boundaries of fintech and digital product standarts.

Globus Bank

Zero to top-charting mobile banking with great collaboration.

Oschadbank

Identification and retrieval of customer data of banks and financial institutions.

UBRD

The first Ukrainian bank with 100% Chinese capital and qualified financial institution

Publicis groupe

Partner with our clients, to make them Win in the Platform World.

RozetkaPay

RozetkaPay is a fintech solution for online payments.

Unex Bank

The first Ukrainian fintech startup with its own banking license.

ProCredit

ProCredit is a German development-oriented bank for Eastern and South Eastern Europe.